Retail Equivalent Value of U.s. Beef Industry ($ Billion)

Report Overview

The global beef market size was estimated at USD 300.6 billion in 2022 and is projected to exhibit a CAGR of 3.1% between 2022 and 2025. Rise in population and consumer disposable income, along with beef emerging as a key source of protein, are major factors driving the market. Beef is one of the most consumed meat forms in the world and is only second to pork in terms of volume consumption. There is a significant supply-demand gap in the market due to the limited production of this meat owing to various environmental and political factors.

Beef and veal (meat from calves) have the highest protein content compared to other meat forms and this is expected to increase their demand as a key source of protein. Veal has the highest protein content of 33.9% per 100 gm of cooked meat, which is higher than any other form of meat. Pork, on the other hand, has a protein content of 29.3% while chicken has 28.9% per 100 gm. China is a prominent market, driven by increasing demand for the meat, supported by rising disposable income. China has witnessed double-digit growth in disposable income and it is expected to maintain the same trend over the coming years. Improving the living standards of the people in the country has resulted in a shift in meat preferences, with most choosing beef-based products rather than products derived from pork and chicken.

Rising urbanization, growing global population, and the need to feed them are some of the key factors expected to contribute to market growth. The rapid and recent spread of diseases in the pork and poultry markets have resulted in consumers turning to beef and associated products. Besides, increasing demand for special cuts of meat, including kosher and halal beef, is anticipated to fuel the market.

Higher prices of beef in comparison to other forms is expected to negatively impact the market. In 2016, beef prices were more than 61.0% higher than other protein sources such as pork and poultry, resulting in decreased demand, primarily in economically affected countries. Also, an imbalance in the supply of cattle may result in an increase in cattle prices over the coming years.

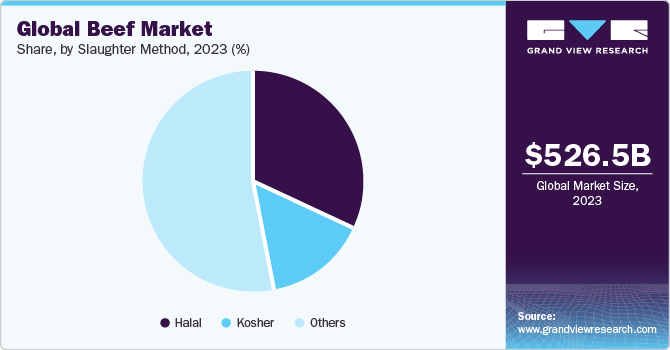

Slaughter Method Insights

Kosher and halal slaughter methods accounted for a revenue share of 14.8% and 18.7% respectively in 2017. Kosher and halal meat is predominantly consumed by Jewish and Islamic population respectively. North America, Europe, and Israel together account for over 80.0% of the global Jewish population. Consumers in North America prefer kosher beef due to significant advantages such as better food safety, quality, and gastronomy.

Increasing the Islamic population around the globe primarily drives demand for the halal segment. Since Islam prohibits the consumption of pork, beef has emerged as one of the most preferred forms of meat in these countries. Demand from the Middle East and African countries is relatively higher, considering the makeup of the population here.

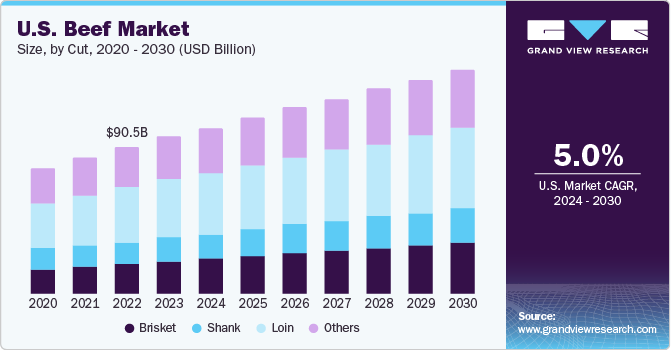

Cut Insights

Based on the cut, the beef market can be segmented into brisket, loin, shank, and others. Brisket is meat around the breastbone; it is the chest or pectoral muscle of the animal and is one of the primal cuts. It is coarse-grained and thick meat and needs a lot of time and low temperature to tenderize and break down. It is one of the most flavorful cuts of the meat and is used in making corned beef, pot roast, and can be slow-cooked in a barbeque or a smoker.

The shank segment is estimated to register a CAGR of 3.3%, in terms of revenue, during the forecast period. Shank is located in the animal's forearms in front of the brisket. As the meat is lean, it is widely used to make low-fat ground beef. The other category includes round, ribs, chuck, plate, and flank and accounted for over 70.0% of the volume in 2017. The segment also held the dominant share in terms of revenue that year.

Regional Insights

North America was the largest market, accounting for 30.4% of the total revenue in 2017. The U.S. was the world's largest producer in 2022 and is anticipated to maintain its dominant position over the coming years, with soaring demand for processed meats. The loin is the most preferred cut in the region and is served in all food outlets. Grass-fed products are highly preferred in the region due to low marbling score.

According to the United States Department of Agriculture (USDA), the U.S. is the largest consumer of beef in the industry as of 2017. The country is ranked fifth in terms of beef per capita consumption in the world after Hong Kong, Argentina, Uruguay, and Brazil. Growth in Jewish and Islamic populations in the U.S. is likely to boost demand for kosher and halal grade meats over the forecast period.

In terms of revenue, the Asia Pacific market is expected to register the highest CAGR of 4.0% over the forecasting period, fueled by countries such as China, Pakistan, Australia, and Japan. Significant growth in disposable income levels, along with changing lifestyles, has created a positive impact on the beef industry in China.

Ongoing shortages in the various consumer markets are likely to support rising imports of frozen beef, with Australia remaining the biggest supplier. India is a key participant in the market as it one of the largest exporters of products, exporting about 1,849 kilotons of the product in 2017.

Key Companies & Market Share Insights

The global market is highly competitive owing to the presence of a large number of multinational players. Increasing demand at the regional and global level is assisting market players to increase their production capacity. Some of the players are also engaged in e-business platforms to expand their distribution channels and footprint in the market.

Players such as Tyson Foods, Inc.; Danish Crown; Cargill, Incorporated; Marfrig Global Foods S.A.; NH Foods Ltd.; NH Foods Ltd.; St Helen's Meat Packers; Hormel Foods Corporation; JBS USA; National Beef Packing Company, LLC; Vion Food Group; and Australian Agricultural Company Limited are engaged in beef processing. Fresh meat, value-added meat, and processed meat are distributed to retailers, chain restaurants, grocery stores, and wholesalers.

Beef Market Report Scope

| Report Attribute | Details |

| Market size value in 2020 | USD 332.49 billion |

| Revenue forecast in 2027 | USD 383.46 billion |

| Growth Rate | CAGR of 3.1% from 2022 to 2025 |

| Base year for estimation | 2017 |

| Historical data | 2014 - 2016 |

| Forecast period | 2017 - 2025 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2022 to 2025 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Cut, slaughter method, region |

| Regional scope | North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; Russia; Switzerland; China; India; Japan; Australia; South Korea; Brazil; Argentina; Colombia |

| Key companies profiled | Tyson Foods, Inc.; Danish Crown; Cargill, Incorporated; Marfrig Global Foods S.A.; NH Foods Ltd.; NH Foods Ltd.; St Helen's Meat Packers; Hormel Foods Corporation; JBS USA; National Beef Packing Company, LLC; Vion Food Group; Australian Agricultural Company Limited |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2025. For this study, Grand View Research has segmented the global beef market report based on cut, slaughter method, and region:

-

Cut Outlook (Volume, Kilotons; Revenue, USD Million, 2022 - 2025)

-

Brisket

-

Shank

-

Loin

-

Others

-

-

Slaughter Method Outlook (Volume, Kilotons; Revenue, USD Million, 2022 - 2025)

-

Kosher

-

Halal

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2022 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

CSA

-

Brazil

-

Argentina

-

Colombia

-

-

MEA

-

Frequently Asked Questions About This Report

b. The global beef market size was estimated at USD 323.92 billion in 2022 and is expected to reach USD 332.49 billion in 2020.

b. The global beef market is expected to grow at a compound annual growth rate of 3.1% from 2022 to 2025 to reach USD 383.46 billion by 2025.

b. Halal certified beef dominated the beef market with a share of 18.8% in 2019. This is attributed to the Increasing Islamic population around the globe since Islam prohibits the consumption of pork, beef has emerged as one of the most preferred forms of meat in these countries.

b. Some key players operating in the beef market include Tyson Foods, Inc.; Danish Crown; Cargill, Incorporated; Marfrig Global Foods S.A.; NH Foods Ltd.; NH Foods Ltd.; St Helen's Meat Packers; Hormel Foods Corporation; JBS USA; National Beef Packing Company, LLC; Vion Food Group; and Australian Agricultural Company Limited.

b. Key factors that are driving the market growth include rise in population, increasing consumer disposable income, and emergence of beef as a key source of protein.

Source: https://www.grandviewresearch.com/industry-analysis/beef-market-analysis

0 Response to "Retail Equivalent Value of U.s. Beef Industry ($ Billion)"

Post a Comment